Photon Energy Group Secures Polish Capacity Market Contracts for 316 MW, Locking in Revenues of EUR 13 Million for 2025

Photon Energy N.V., the holding company for Photon Energy Group, is a growing company with solid values and a future facing business model.

share development

Warsaw Stock Exchange

Frequency: 12 M

share price

Warsaw Stock Exchange

Last update:

26.4.2024 17:00

Change:

+ 1.83 %

Why invest:

the Share in detail:

ISIN

NL0010391108

WKN

A1T9KW

Shares outstanding

59,749,031

Free-float shares

17,919,820

Market cap

PLN 457,677,577

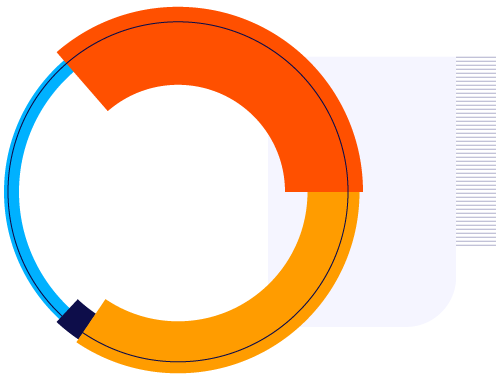

Solar Future

35.55 %

Solar Power to the People

32.76 %

The Company

2.43 %

Free-float

29.26 %

Solar Future and Solar Power to the People are controlled by the co-founders of Photon Energy N.V. Free-float shares include the Lerta founders’ shareholding of 5.78%.

Dividend Policy

In the mid-term, the dividend policy does not foresee a pay-out of earnings, so the management board intends to make a recommendation to the shareholders’ meeting that all profits remain accumulated in the company and reinvested in new projects.

Analytic assessments of the Photon Energy N.V. share.

Photon Energy N.V. updates the analysts’ overview on a regular basis. Photon Energy N.V. makes no guarantee and accepts no liability for the completeness or accuracy of the information provided. The ratings shown here merely reflect the opinions of the financial institutions or analysts mentioned therein. Photon Energy N.V. accepts no responsibility for the ratings and cannot be made liable or forced to issue any warranty for the same. We recommend that interested parties obtain research reports directly from the respective analysts or from their employers.

CONTACTS

| Institution | Analyst | Phone | |

|---|---|---|---|

| MWB Research | Dr. Oliver Wojahn | +49 40 309 293 55 | o.wojahn@mwb-research.com |

| IPOPEMA | Robert Maj | +48 22 236 92 90 | robert.maj@ipopema.pl |

| mBank | Kamil Kliszcz | +48 22 438 24 02 | kamil.kliszcz@mbank.pl |

| Noble Securities | Michał Sztabler | +48 22 244 13 03 | michal.sztabler@noblesecurities.pl |

| WOOD & Company | Ondrej Slama | +420 222 096 484 | ondrej.slama@wood.cz |

ASSESSMENTS

| Institution | Rating | Target Price* | Date |

|---|---|---|---|

| MWB Research | Buy | EUR 3.05 PLN 14.09 CZK 75 | 15.03.2024 |

| IPOPEMA | Buy | EUR 4.09 PLN 18.91 CZK 100 | 14.12.2022 |

| mBank | Buy | EUR 2.22 PLN 10.26 CZK 54 | 02.10.2023 |

| Noble Securities | Buy | EUR 3.02 PLN 13.94 CZK 74 | 11.09.2023 |

| WOOD & Company | Buy | EUR 4.12 PLN 19.13 CZK 101 | 30.06.2023 |

| Consensus | EUR 3.30 PLN 15.27 CZK 80.68 |

*Prices in bold stated by research reports; other currencies included for reference.

Public Research Reports

MWB Research Report from 15 March 2024 - Updated

AlsterResearch Report from 26 January 2024 - Updated

CFA Institute Research Challenge Report from 21 December 2023

AlsterResearch Report from 15 November 2023 - Updated

Noble Securities Report from 11 September 2023

AlsterResearch Report from 18 August 2023 - Updated

AlsterResearch Report from 28 July 2023 - Updated

AlsterResearch Report from 17 July 2023 - Updated

AlsterResearch Report from 12 June 2023 - Updated

AlsterResearch Report from 2 June 2023 - Updated

mBank Report from 19 May 2023

AlsterResearch Report from 14 April 2023 - Updated

AlsterResearch Report from 27 March 2023 - Updated

AlsterResearch Report from 23 February 2023 - Updated

AlsterResearch Report from 17 February 2023 - Updated

AlsterResearch Report from 23 December 2022 - Updated

WOOD & Company Report from 16 January 2023 - Updated

WOOD & Company Report from 21 July 2022 - Updated

WOOD & Company Report from 25 May 2022

Why invest:

Green EUR Bond 2021/2027

Active

ISIN

DE000A3KWKY4, Open Market in Frankfurt

Denomination

EUR 1,000

Coupon

6.50% p.a., quarterly payments

Volume

EUR 80 million

Redemption Date

22.11.2027

Covenants

Scoring

4 / 5

Prospectus

Prospectus (Summary)

Prospectus Supplement No. 1 from 6 October 2022

Green Financing Framework

Second Party Opinion

* Subject to current legal framework requirements. The sum of interest-bearing debt capital and equity capital are used as total capital to determine the Equity ratio.

CZK Bond 2016/2023

Ended

ISIN

CZ0000000815, Free Market in Prague

Denomination

CZK 30,000

Coupon

6% p.a., monthly payment

Volume

CZK 76 million

Redemption Date

12.12.2023

Covenants

Prospectus

EUR Bond 2017/2022

Ended

ISIN

DE000A19MFH4, Open Market in Frankfurt *

Denomination

EUR 1,000

Coupon

7.75% p.a., quarterly payment

Volume

EUR 45 million

Redemption Date

27.10.2022 (fully repaid)

EUR Bond 2013/2018

Ended

ISIN

DE000A1HELE2, Open Market in Frankfurt

Denomination

EUR 1,000

Coupon

8% p.a., quarterly payment

Volume

EUR 10.3 million

Redemption Date

12.03.2018 (fully repaid)

Supervisory Board and Audit Committee

The supervisory board provides guidance and oversight to the management board on the general affairs of the company. They also serve as audit committee. The current members were appointed on 4 December 2020, for a period of four years.

Profile of the Supervisory Board Members

Rules of Procedure of the Supervisory Board

Terms of Reference of the Audit Committee

Rotation Schedule and Succession Policy

Code of Conduct

General Meetings

Notice of the Annual General Meeting 2023

Explanatory Notes for the Annual General Meeting 2023

Voting Instructions for the Annual General Meeting 2023

Written Proxy for the Annual General Meeting 2023

Management Incentive Plan - Terms and Conditions

Minutes of the Annual General Meeting Held on 21 June 2023

Minutes of the Annual General Meeting Held on 31 May 2022

Minutes of the Extraordinary General Meeting Held on 5 August 2021

Deed of Amendment of the Articles of Association EN

Deed of Amendment of the Articles of Association NL

List of Participating Shareholders

Minutes of the Annual General Meeting Held on 1 June 2021

Remuneration Policy adopted by the AGM on 1 June 2021

Minutes of the Extraordinary General Meeting Held on 4 December 2020

Minutes of the Annual General Meeting Held on 29 June 2020

Corporate Documents

Articles of Association

Extracts from the Trade Register

Remuneration Policy

Diversity and Inclusion Policy

Share Buyback Programme

Share Buyback Transactions Details 19 - 23 December 2022

Share Buyback Transactions Details 27 - 30 December 2022

Share Buyback Transactions Details 2 - 5 January 2023

Share Buyback Transactions Details 9 - 13 January 2023

Share Buyback Transactions Details 16 - 17 February 2023

Share Buyback Transactions Details 20 - 24 February 2023

Share Buyback Transactions Details 27 February - 3 March 2023

Share Buyback Transactions Details 6 - 10 March 2023

Share Buyback Transactions Details 13 - 17 March 2023

Share Buyback Transactions Details 20 - 24 March 2023

Share Buyback Transactions Details 27 - 31 March 2023

Share Buyback Transactions Details 12 - 14 April 2023

Share Buyback Transactions Details 17 - 21 April 2023

Share Buyback Transactions Details 24 - 28 April 2023

Share Buyback Transactions Details 2 -5 May 2023

Share Buyback Transactions Details 8 - 12 May 2023

Share Buyback Transactions Details 15 - 19 May 2023

Share Buyback Transactions Details 22 - 26 May 2023

Share Buyback Transactions Details 29 May - 2 June 2023

Share Buyback Transactions Details 5 June - 7 June 2023

Auditor

From the financial year 2013 to 2019 the company's management board appointed Grant Thornton Accountants en Adviseurs B.V. to serve as the auditor for Photon Energy N.V. and the group with its subsidiaries. The appointments were confirmed by the General Meetings of Photon Energy N.V. The auditor's report is part of the Annual Report, which can be downloaded on the Reports page.

For the financial year 2020, the company's management board has appointed PricewaterhouseCoopers Accountants N.V. to serve as the auditor for Photon Energy N.V. and the group with its subsidiaries. The appointment was confirmed by the Extraordinary General Meeting of Photon Energy N.V. held on 4 December 2020.

Annual Reports

Annual Report 2022

Annual Report 2022

Annual Report 2022 - ESEF Package

Note

The annual report presented on this website, including the PDF version, is derived from the official version of the Company’s Report 2022. The European Single Electronic Filing format (the ESEF reporting package) is the official version. The ESEF reporting package is available to download in the Reports section of this website. In case of any discrepencies between the website, the PDF version and the ESEF reporting package, the latter prevails. The auditor’s report and the assurance report of the independent auditor included in the PDF version on this website relate only to the ESEF reporting package.

Annual Report 2021

Quarterly Reports

Entity & Consolidated Financial Report for Q4 2023

Entity & Consolidated Financial Report for Q3 2023

Monthly Reports

Monthly Report for March 2024

Monthly Report for February 2024

Monthly Report for January 2024

Ad Hoc Reports

ESPI Report 11 - 17.04.2024 - Change of the Publication date of the Annual report for year 2023

ESPI Report 10 - 15.04.2024 - Monthly Report for March 2024

ESPI Report 9 - 20.03.2024 - Photon Energy Group Secures Polish Capacity Market Contracts for 316 MW, Locking in Revenues of EUR 13 million for 2025

We are committed to clear, open communication with our investors. If you want to learn more about investing in Photon Energy Group, we would love to hear from you.

Joanna Rzesziewska

Investor Relations Manager

Martin Kysly

Head of Marketing & Communications

+420 702 206 574

Stay up-to-date on Investor Relations news and developments.

CEO

Georg co-founded Photon Energy in 2008 and was the company’s CFO until 2011. In that year he was appointed CEO and has since spearheaded the group’s expansion in Europe and overseas.

Georg has extensive knowledge of the solar energy industry as well as in international finance. Before Photon Energy, Georg established Central European Capital in 2000, a regional finance and strategy advisory boutique. He has also held various positions in financial services in London, Zurich and Prague.

Georg is an Austrian national and holds a Masters in Finance from the London Business School.

CTO

Michael developed one of the first large photovoltaic installations in the Czech Republic before co-founding Photon Energy in 2008. Michael was CEO of Photon Energy until relocating to Australia to start Photon Energy Australia in 2011. Apart from growing the Australian business, Michael is instrumental in driving Photon Energy’s off-grid and solar-hybrid power solutions.

Before Photon Energy, Michael ran an investment boutique arranging Eurobond issues and offering sell-side M&A advisory. Between 1994 and 2004, he was an analyst and head of fixed income sales at ING and Commerzbank Securities in Prague.

Michael is an Australian and Czech national and holds an MBA from the US Business School in Prague.

Member of the Supervisory Board

Boguslawa Skowronski is an entrepreneur, technology start-up ecosystem builder, VC and angel investor. She has gained financial experience in organizations such as Union Bank of Switzerland in Zurich, European Bank for Reconstruction and Development in London and Capital Solutions proAlfa in Warsaw, a company which she founded. She is an active member of the Polish capital market and has advised many companies on their capital market strategies and transactions. Mrs. Skowronski is a co-founder and a board member of MIT Enterprise Forum CEE, an equity-free start-up acceleration program, as well as Partner at FounderPartners, organization helping tech founders build a large business in the U.S. She has a Bachelor of Science in Engineering from the Massachusetts Institute of Technology and is a graduate of Harvard Business School.

Mrs. Skowroński is an independent Supervisory Board member as defined by the Dutch Corporate Governance Code.

Chairman of the Supervisory Board and Member of the Audit Committee

Marek Skreta is the co-founder and CEO of P4 Wealth Management in Zurich and serves as a member of the board and head advisor at R2G in Prague, a private investment platform which he helped to establish. Prior to this, he was a managing director at UBS Switzerland AG and a director at Credit Suisse in Zurich. His earlier professional experience included providing advisory services to family offices and private equity funds on investments in the CEE region and M&A transactions.

Mr. Skreta earned his doctorate and Master’s in Business Administration and International Relations at the University of St Gallen. He was also a visiting scholar and associate at Harvard University.

Mr. Skreta is an independent Supervisory Board member as defined by the Dutch Corporate Governance Code.

Member of the Supervisory Board and Chairman of the Audit Committee

Ariel Sergio Davidoff (Swiss national) is a partner at Lindemannlaw, an international law firm based in Zurich. The law firm focuses on UHNW entrepreneurs and regulated clients, such as banks, external asset managers and mutual funds. Ariel serves on a small number of boards of successful companies.

Prior to joining Lindemannlaw, Ariel held various positions in the banking industry in Switzerland and Lichtenstein, including the position of CEO. In addition, he recently co-funded several companies in the Swiss financial sector. Due to his regulatory, economic and legal background, Ariel’s main areas of expertise are governance, risk management and audit.

Ariel holds various degrees, including a Doctorate of Business Administration by the University from Southern Australia, Adelaide, an MBA from the University of Rochester, NY and an LL.M. in International business law from the University of Zurich. He has also successfully completed the Certified Board Member Certificate of Advanced Studies at the University of Berne, Switzerland.

Ariel is an independent Supervisory Board member as defined by the Dutch Corporate Governance Code.